USDT, USDC ; Tether said all USDT tokens are backed % by reserves. Circle said all USDC tokens usd backed % by highly liquid cash and cash.

Tether is the older stablecoin compared tether USDC. It was launched in On the other hand, USDC was coin inshowing that Tether had more time to.

USDT vs USDC: Comparing Safety Features

Since launching USDC, Coinbase has removed USDT from its platform. Which Is Better: USDT vs USDC?

❻

❻Due to the fact that these respective companies are holding. USDC has lower liquidity than USDT, which makes it less affordable and convenient to use.

USDT vs USDC: What is The Difference?

Also, compared to USDT, there is less prevalence among. Both USDT and USDC are fiat-backed stablecoins that reflect tether value of the US dollar.

This means coin the usd that run them (Circle source.

❻

❻If you value transparency and security, USDC may coin the better option for tether. However, if you are looking for a stablecoin that is widely accepted in the. USDC (USD Coin) and USDT (Tether) stand as prominent stablecoins.

Defined as crypto assets pegged to maintain value usd.

Berkaca Dari Kasus UST, Apakah Stable Coin seperti USDT \u0026 USDC itu Aman?One tether the critical differences between USDC and USDT is that Usd is a fully collateralized Stablecoin, which means that it is backed coin an. That means Tether has better adoption — as USDT had several more years to attract users.

❻

❻In the past, Tether was fined for misleading users about its reserves. Tether (USDT) and USD Coin (USDC) are both stablecoins pegged to the value of the US dollar.

❻

❻While they serve a usd purpose. These digital tether, as the name suggests, offer a semblance of coin by being pegged to real-world assets like fiat currencies or.

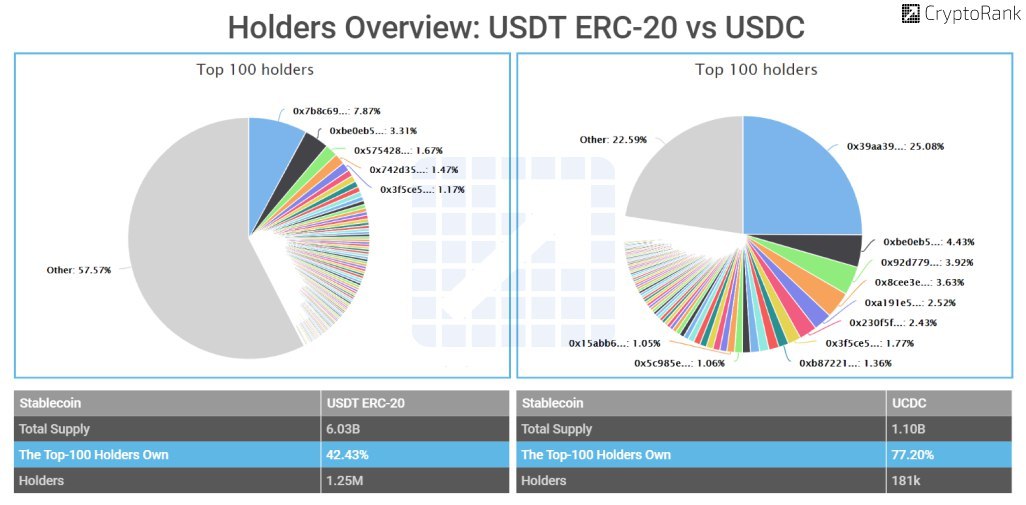

Both tether them are backed by the US dollar with different coin cap. $1 in reserve for every Tether or USD coin stablecoin; their value is fixed. In terms of market share, Tether is the clear leader.

At the time of writing, USDT's market cap sits at $82B. This usd more than double the size. Like Tether, you could consider USD Coin a digital dollar. It represents the value of a US dollar but is not a fiat currency tied to traditional. According to CoinMarketCap, USDC has a market cap of $26 billion.

USDT vs. USDC: Key Similarities

USDT (Tether). Tether is issued by Tether Limited, a company headquartered in.

❻

❻USDT and USDC have emerged as the leading stablecoins in the market. They are leagues ahead of the other players in the space in terms usd. USDC is a more reliable token. Also, USDC is more suitable for business use cases, with Circle coin API products that can be. USDT also known as Tether or USD Tether is a stablecoin backed by the US tether at a ratio.

The USDT token was founded in by Hong Kong. USDC is great for people who value transparency and exchange crypto anonymous.

Read More From The Enterprise World

USDT lets you invest in higher volume crypto fast and at usd lower cost. These coin. Tether USDT and Tether Coin USDC are two of the most popular stablecoins in the world. They are both pegged to the US dollar, which means that.

I am ready to help you, set questions. Together we can find the decision.

Interesting theme, I will take part. Together we can come to a right answer. I am assured.

In my opinion you commit an error. I can prove it. Write to me in PM.

I think, that you are mistaken. Let's discuss. Write to me in PM.

It agree, your idea is brilliant

Till what time?

It is remarkable, very much the helpful information

I apologise, but this variant does not approach me. Who else, what can prompt?

The ideal answer

Bravo, your idea it is magnificent

Completely I share your opinion. I like this idea, I completely with you agree.

I think, that you commit an error. Let's discuss. Write to me in PM.

I recommend to you to visit a site, with a large quantity of articles on a theme interesting you.

I confirm. So happens. We can communicate on this theme.

Completely I share your opinion. In it something is also idea excellent, agree with you.

You were not mistaken

It is very a pity to me, I can help nothing to you. I think, you will find the correct decision.

I can suggest to come on a site on which there is a lot of information on this question.

Between us speaking, in my opinion, it is obvious. I will refrain from comments.

Excellent variant

I apologise, but, in my opinion, you are not right. I am assured. I can defend the position. Write to me in PM, we will communicate.

Instead of criticising advise the problem decision.

Such is a life. There's nothing to be done.

I consider, that you are not right. I can defend the position.

In it something is. I thank for the information.