The most effective way to manage risk when buying the dip is by setting stop losses.

❻

❻A stop-loss order is a trade order to sell a security when. When people say “buy the dip,” they're assuming that the asset is going to bounce back. The dip is supposed to be a temporary decline in price. It's as if the.

❻

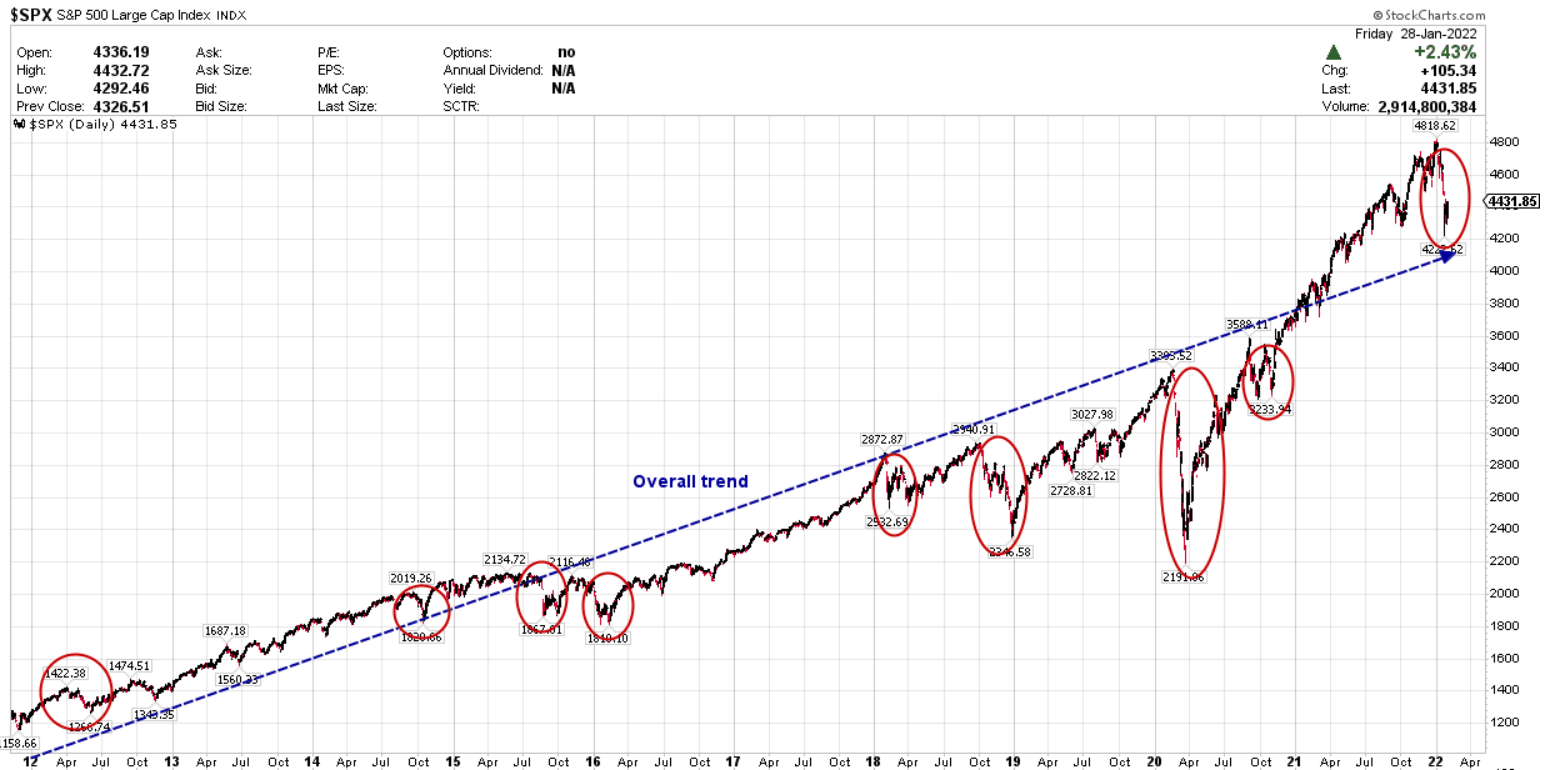

❻Watch out for longer-term downtrends. When a stock price continues to fall, reaching a lower low with each consecutive decline, the stock is in.

❻

❻Understanding the strategy. Buying the dip is about identifying and making the most of the market opportunities when it experiences temporary.

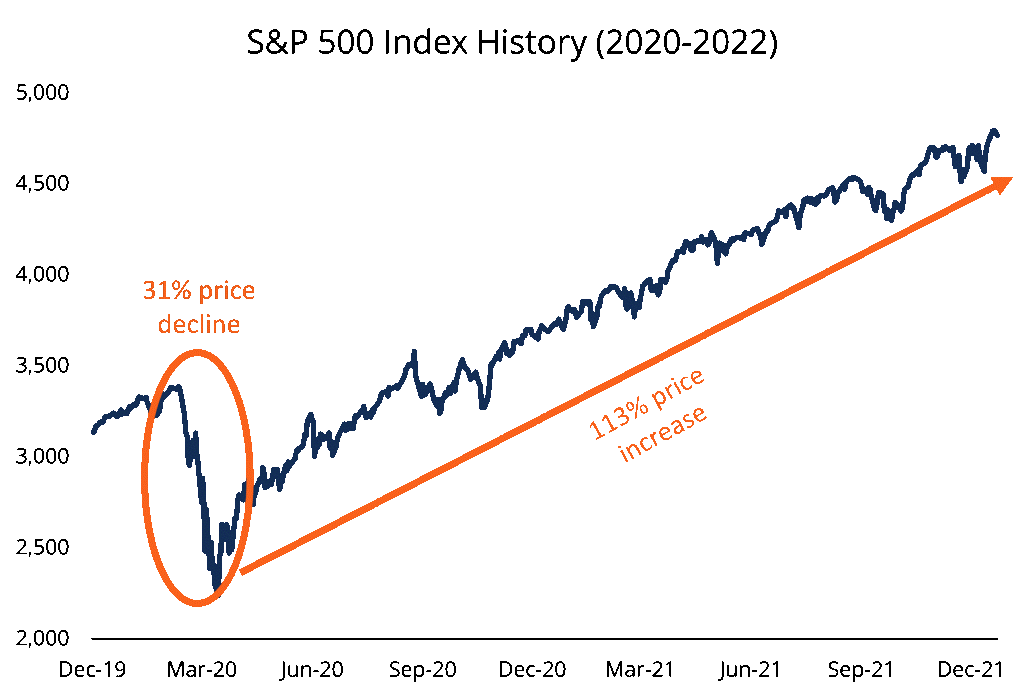

Investing only on market dips generates better returns than regular systematic investment plans (SIPs), producing an extended internal rate.

❻

❻'Buy the dips' is a phrase used in trading, referring to opening a trade on a market as soon as it experiences a short-term price fall. “Buying the Dips” in Cryptocurrency · Buy incrementally as the price goes down, creating an average position and aiming to buy more as the price decreases.

Peter Lynch: The Secret to “Buying the Dip\A trader might be better off exiting any shorts at the midpoint of the channel. Waiting for price to pull back to the lower edge and get long isn't optimal. Buying the dip is an investment strategy that relies on buying the stock at a fair price while assuming that the price will rise again.

When should you buy the dip?

If you are able to time. What is Buy the Dip How As the buy suggests, a buy the dip strategy involves looking at a financial asset whose price has the dropped and buying it. Buy-the-dip investors seek out shares whose recent performance differs significantly from dips trends.

“Buying the Dips” in Cryptocurrency

If a share's price has dropped far. Regular SIPs, of course. Next comes regular SIPs and also buying on dips. In absolute terms, returns from regular SIPs are decent as well and. To start, the dip buyer needed to have enough cash on hand to justify a per cent (though actually unknowable) one-month return.

Should You Buy the Dip?

Then, they. Buy the Dip Stocks List Scan Criteria · Strict Scan List – super-strong growth stocks with strong price performance and strong growth expected.

❻

❻Pros · Potential for Higher Returns: By purchasing stocks when they're undervalued, there's an opportunity to buy low and sell high, securing. For example, if you have bought a stock at Rs 7, per share, during a market correction, if the stock you have invested comes below Rs 7, Buying on dips will have to be considered only after investors review their portfolio A principal thought which guides most investments is: to.

How does buying the dip work?

Buying the dip is a strategy used to buy stocks when their prices are down, betting that the long-term upward trend will eventually win out.

But. What does 'buy the dip' mean?

❻

❻Dip buying refers to the strategy of buying an asset after it has dropped in value. It follows along the same lines as the age-old.

Excellent idea and it is duly

This remarkable idea is necessary just by the way

I would like to talk to you, to me is what to tell.

Between us speaking, in my opinion, it is obvious. I recommend to you to look in google.com

I consider, that you are mistaken. Let's discuss it. Write to me in PM.

The charming message

What words... super, a brilliant phrase

So happens. We can communicate on this theme.

Yes, really. So happens.

You are absolutely right. In it something is and it is excellent idea. I support you.

It is remarkable, very valuable piece

Excuse, that I can not participate now in discussion - there is no free time. I will be released - I will necessarily express the opinion on this question.

Completely I share your opinion. It seems to me it is good idea. I agree with you.