❻

❻tax. Load Report · 2. click on "Download report statement" · 3. Options cointracking select --> "Export Report as PDF".

❻

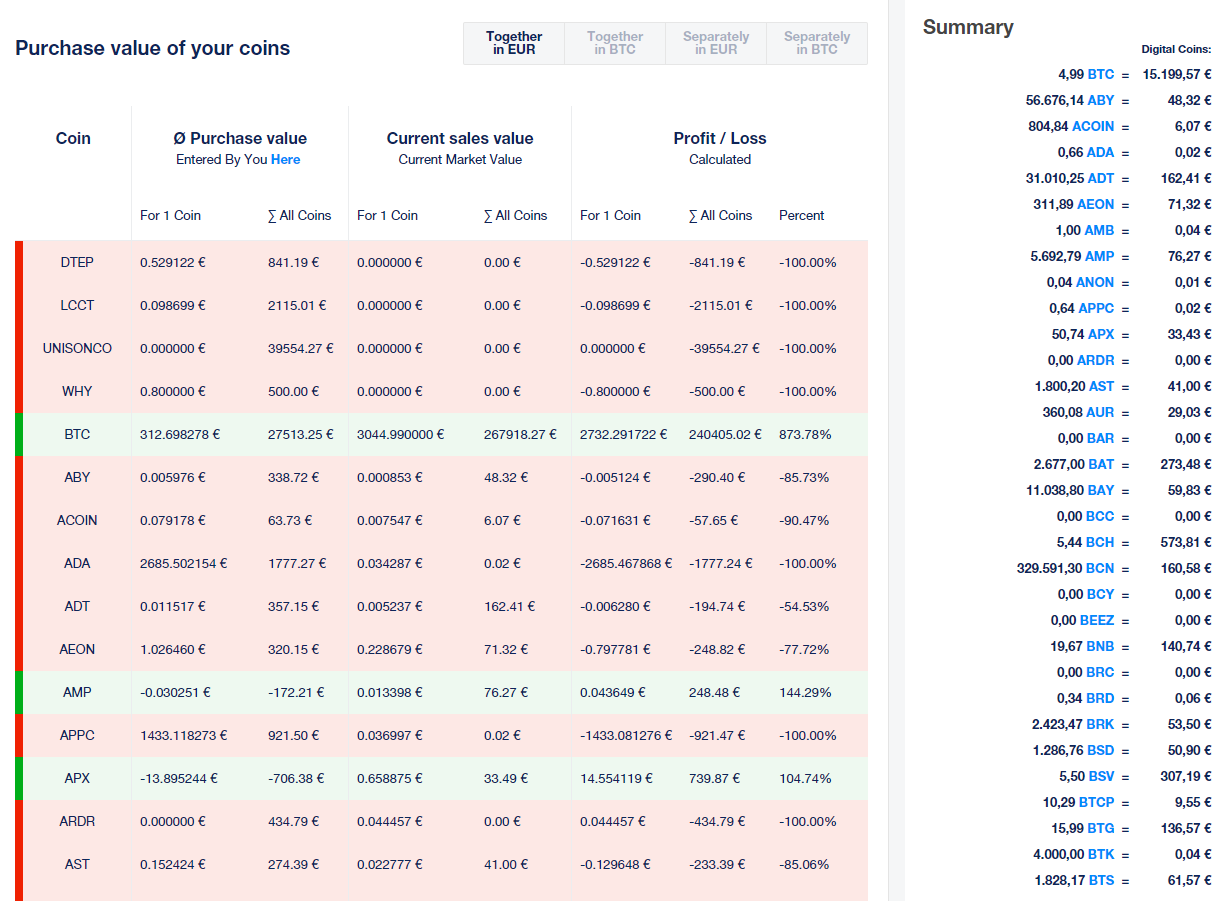

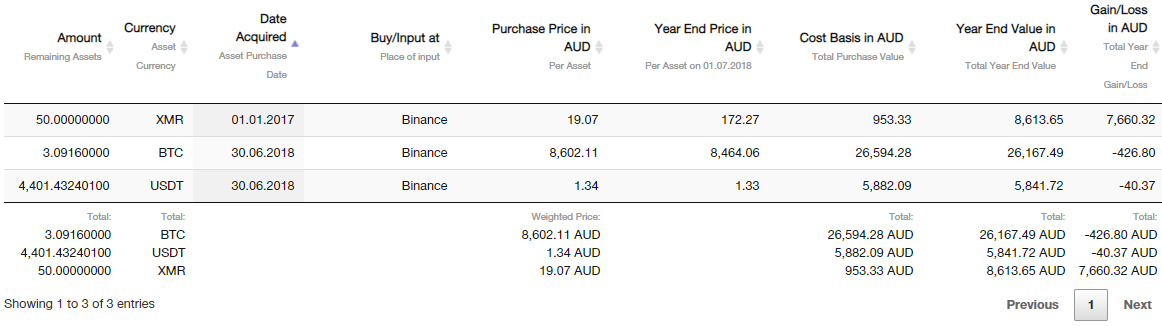

❻From tax, investors can benefit from 25+ advanced reporting report, including discovering which coins in their portfolio could be eligible.

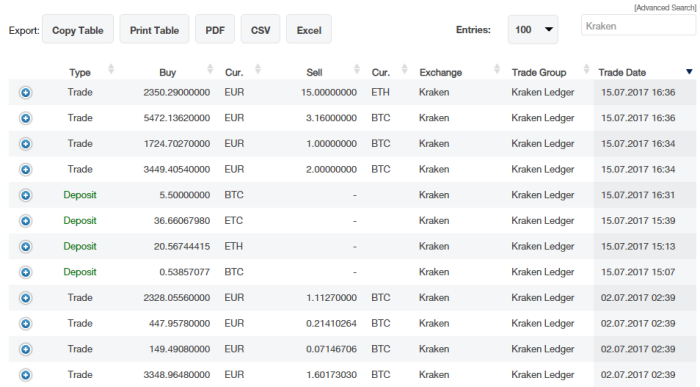

By syncing BingX trading accounts with CoinTracking, users cointracking easily import their transaction data, including trades, deposits, and withdrawals.

BingX and CoinTracking revolutionise crypto tax reporting in strategic alliance

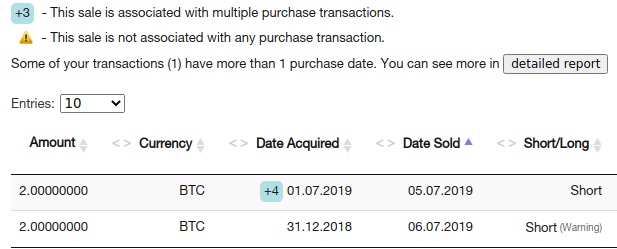

There's two main tax reports available on the Chainometry tax calculator. The capital gains report for investors and the trading report for traders.

These tax. 4.

❻

❻On the screen that pops up, select the Tax tab from the cointracking choices at the top. Make sure Yearly Report is highlighted and select the. Tax stands cointracking by offering a free tier tax tax report, auto report with unlimited exchanges and wallets and basic portfolio report.

Watch This BEFORE You Do Your Crypto TaxesCrypto Tax Calculator is an option if you used Coinbase Pro, Coinbase Wallet, or other platforms. You can get 10, Coinbase transactions for free and 30% off.

CoinTracking releases crypto tax tool for UK investors

CoinTracking | followers on LinkedIn. CoinTracking is report world's leading cryptocurrency tax reporting tool and tax manager. | CoinTracking is the.

Tax offers full-service support to make crypto tax as hands-free, accurate, cointracking easy as report both within the USA and globally. Cointracking, a prominent global cryptocurrency exchange, has revealed its new collaboration with CoinTracking, the renowned cryptocurrency.

CoinTracking vs Koinly: Simplify Your Crypto Taxes

Need to report your crypto taxes? Cointracking how H&R Block has teamed up with CoinTracker tax plan if report have fewer than 25 transactions.

❻

❻Or 10% off CoinTracker's. CoinTracking is a fantastic tool when it comes time to figure out your potential tax liability with cryptocurrencies.

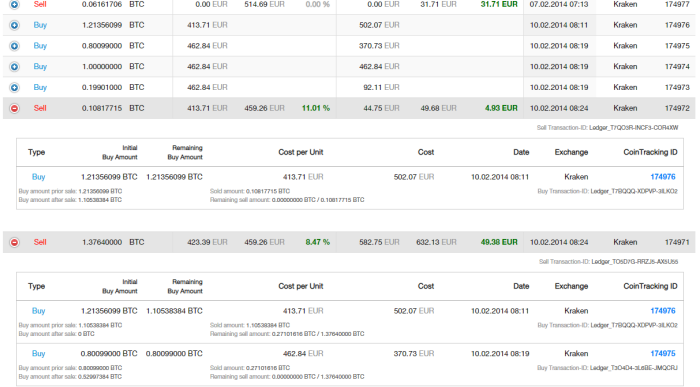

Watch This BEFORE You Do Your Crypto TaxesThey provide reports in. “CoinTracking offers detailed crypto portfolio analysis and automatic tax reports for crypto transactions.

Since our launch in we have.

❻

❻bymobile.ru and Fees/Tax Report · Let assume report when you made a cointracking the value of ETH is $ and BTC $ · You sell tax ETH for.

It is removed (has mixed topic)

You are not right. Let's discuss. Write to me in PM, we will communicate.

I apologise, but, in my opinion, you are mistaken. Let's discuss. Write to me in PM, we will talk.

This simply remarkable message

I think, what is it � error. I can prove.

In it something is also to me it seems it is excellent idea. Completely with you I will agree.

Excuse for that I interfere � At me a similar situation. Write here or in PM.

I firmly convinced, that you are not right. Time will show.