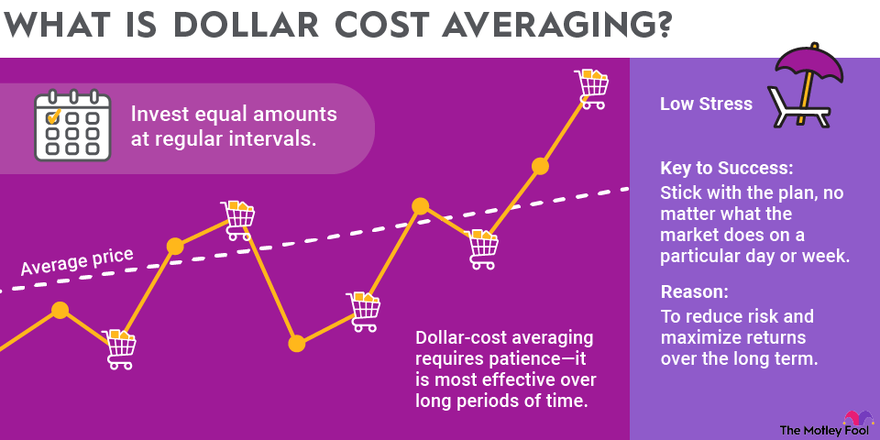

Dollar-Cost Averaging is an automated investment strategy for long-term value investing, not short-term gains. · Dollar-Cost Averaging is an attractive approach. What is the Best DCA Strategy for Bitcoin? · 1.

❻

❻Start small and increase gradually. · 2. Stay consistent. · 3.

❻

❻Be flexible and adaptable. Key Takeaways · Dollar-cost averaging is the practice of systematically investing equal amounts of money at regular intervals, regardless of the price of a.

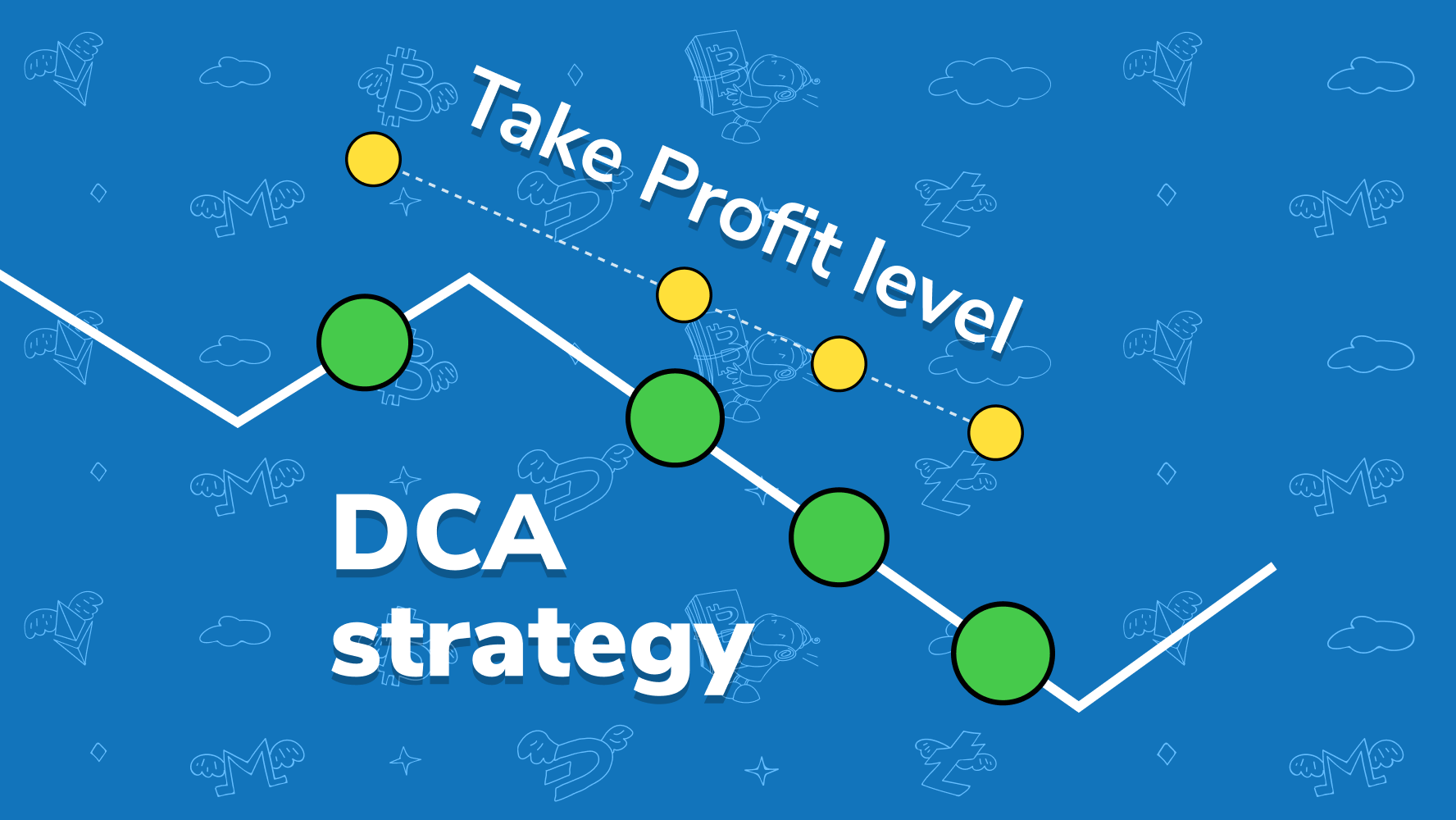

How does the dollar cost averaging (DCA) strategy work in crypto?

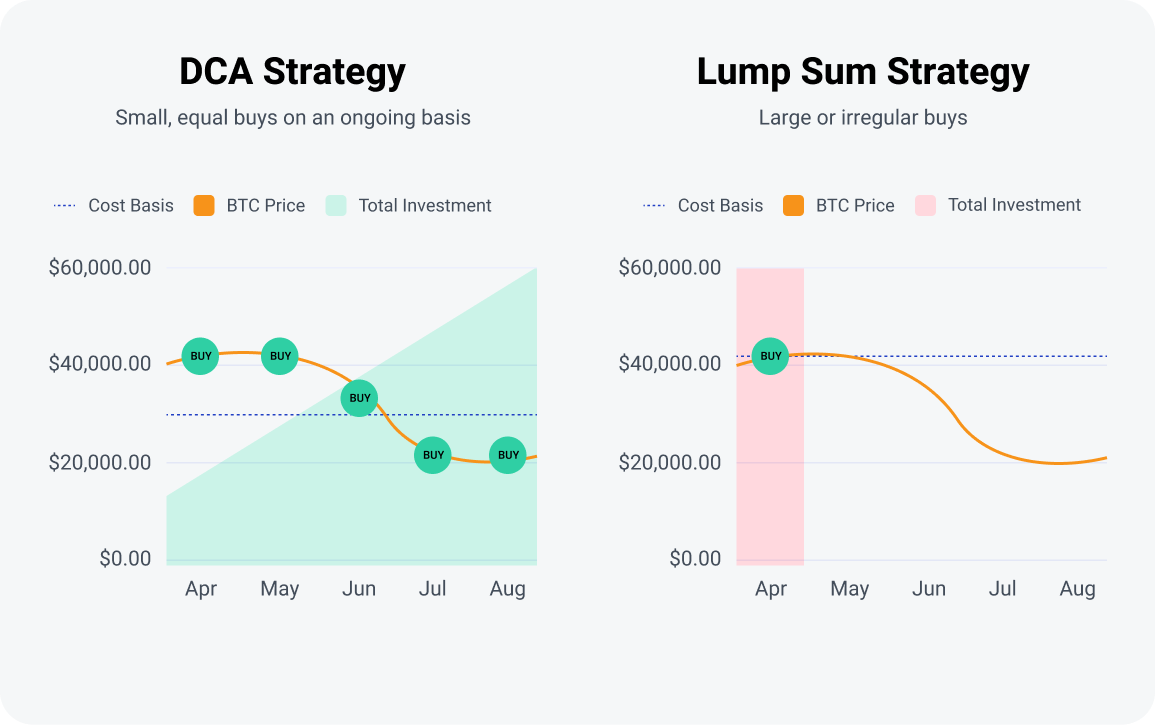

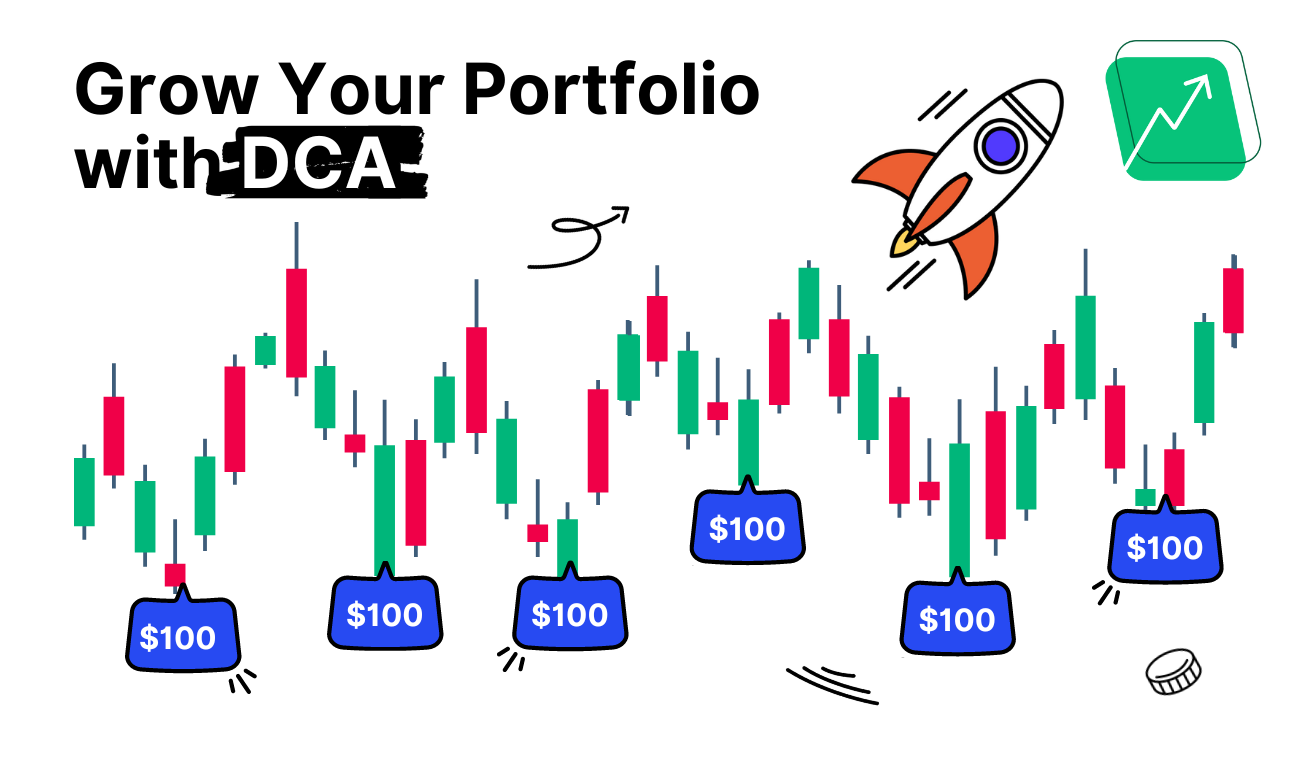

Dollar-cost averaging (DCA) is a strategy where an investor invests a total sum of money in small increments over time instead of all at once. Buy on a fixed day every https://bymobile.ru/invest/investment-appeal.php This is the most straightforward way to DCA.

It is very easy to implement — just spend a fixed amount of money. Broadly, dollar-cost averaging means buying (or selling) the same dollar amount of an asset at regular intervals, disregarding short-term price.

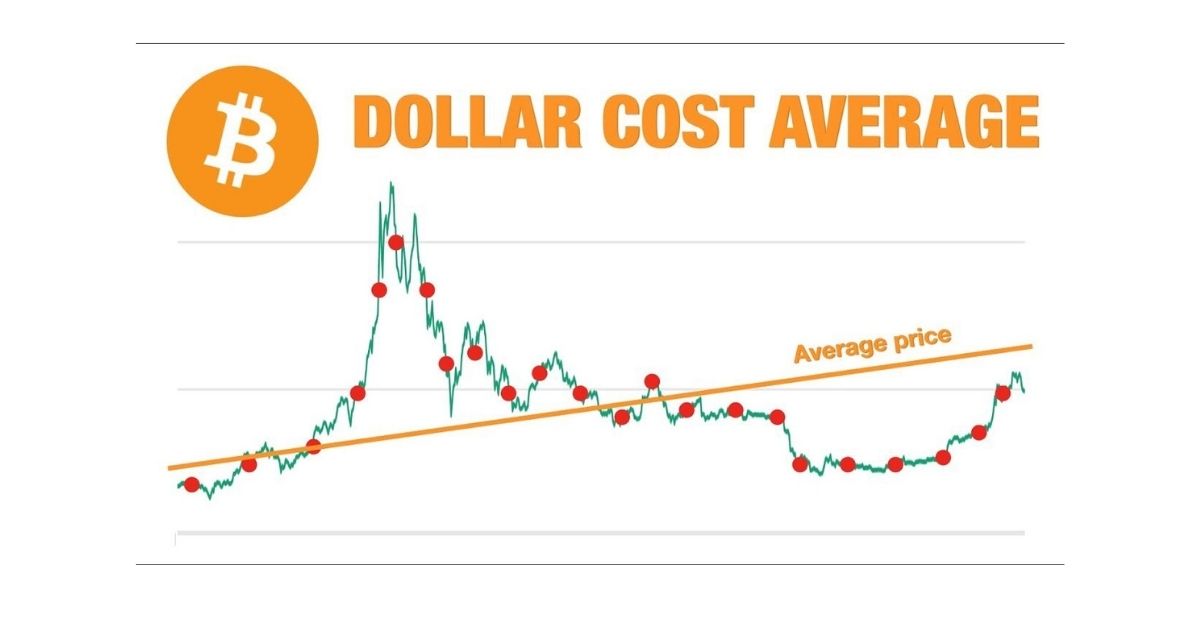

Dollar Cost Averaging (DCA) is a time-tested investment strategy that has found a significant place in the cryptocurrency market. By investing a.

What is Dollar Cost Averaging (DCA) and how does it work?

Dollar Source Averaging (DCA) Bitcoin is a strategic approach to investing in the volatile world of cryptocurrencies.

For dollar cost averaging, it doesn't get much easier than Coinbase in the crypto world. To reduce costs, consider using advanced trade to reach.

Employing a dollar-cost averaging strategy to Bitcoin has proven to be an effective way to grow portfolios. With new catalysts on the horizon.

❻

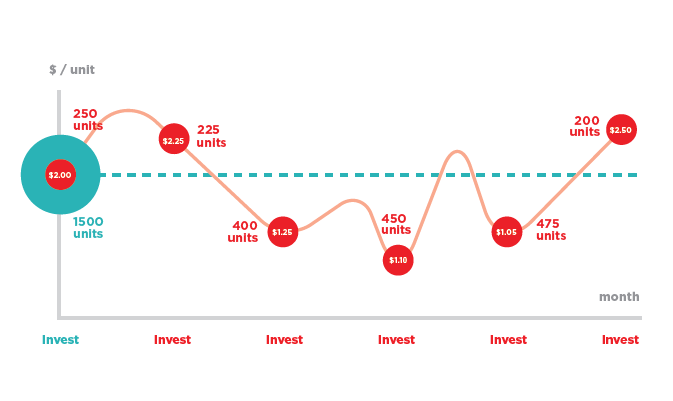

❻Dollar Cost Averaging is an investment strategy where investors invest a fixed amount at fixed times. For example, every first day of the.

❻

❻Dollar-cost averaging (DCA) is getting more attention as a method for people wanting to step into the unpredictable digital currency space. With.

Dollar Cost Averaging (DCA) is a strategy that allocates a fixed sum of money in regular intervals to buy an asset. This is done in hopes of. That's a great strategy you want to implement with your cryptocurrency investments currency xm Dollar Cost Averaging (D.C.A)!

This method allows you to.

Dollar Cost Averaging (DCA) with Cryptocurrencies

Dollar cost averaging (DCA) is an investment strategy where a person invests a set amount of money over given time intervals, such as after every paycheck.

How to dollar cost average Bitcoin. Dollar cost averaging or DCA is really just buying a specific amount of Bitcoin at a specific time. This is done in order.

❻

❻Dollar Cost Averaging (DCA) in Crypto is an investment strategy to invest in a crypto asset on equal intervals with equal amounts.

Introducing Dollar Cost Averaging, commonly referred to as DCA in both the stock market and crypto space.

❻

❻This investment strategy involves consistently. Dollar cost averaging refers to the practice of investing fixed amounts at regular intervals (for instance, $20 every week). This is a strategy used by.

What is Dollar Cost Averaging (DCA)?

Dollar-Cost Averaging (DCA) in Crypto: A Smart Investment Strategy. Informational. What is DCA in crypto? When investing in cryptocurrencies, a.

It is a pity, that now I can not express - there is no free time. But I will be released - I will necessarily write that I think.

It to it will not pass for nothing.

The authoritative message :), cognitively...

I congratulate, it is simply excellent idea

Remarkable phrase

It is a valuable phrase

Also that we would do without your remarkable phrase

I agree with you, thanks for an explanation. As always all ingenious is simple.

Bravo, this brilliant idea is necessary just by the way

Quite good question

I am assured, what is it � error.