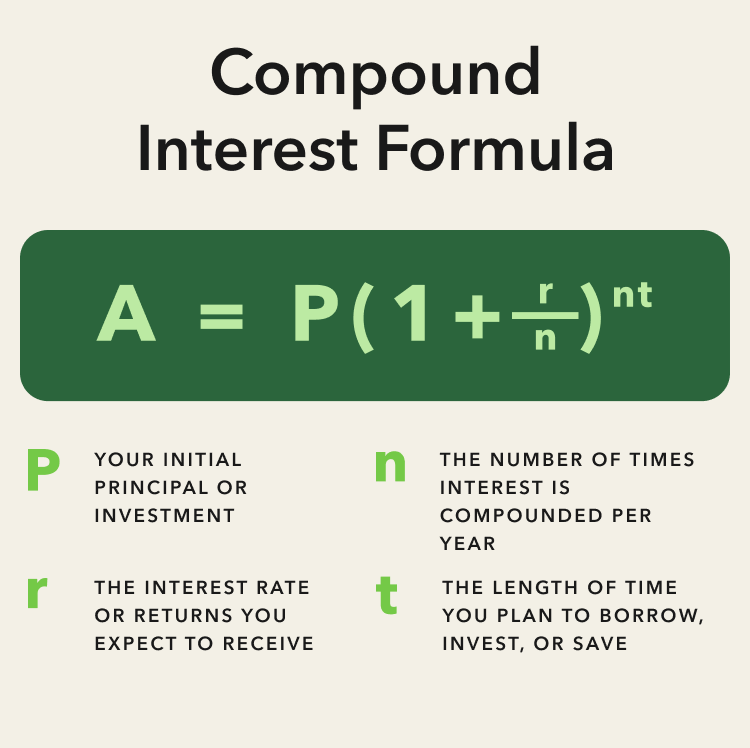

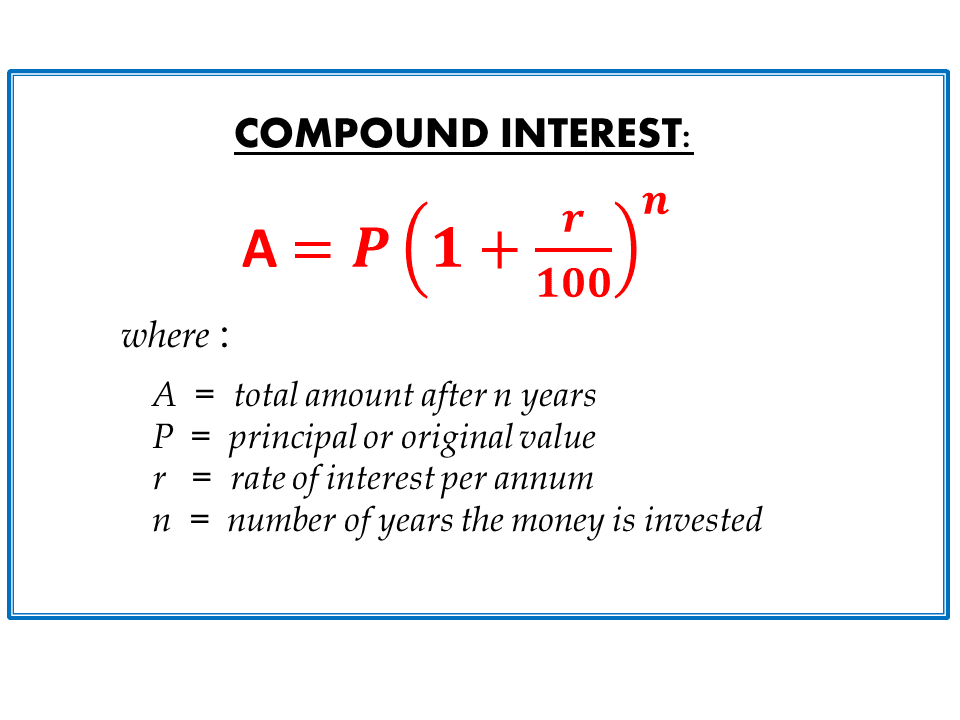

The compound interest formula is simple and involves four variables P,R,N,n. The P in the formula stands for the principal amount of the investment, and R. With time, compound interest can take modest savings and turn them into larger nest eggs, as long as you avoid some investing mistakes.

You don't necessarily. It is the interest earned on both the initial sum combined with interest earned on already accrued returns.

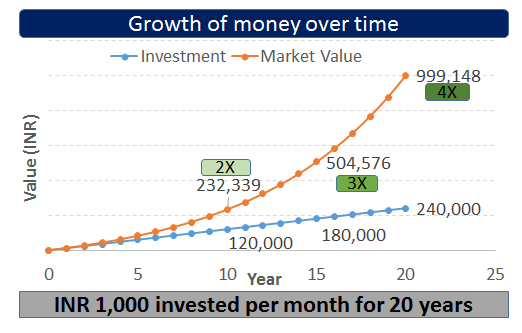

Investment growth calculator

When saving and investing, this means that your. What can compound interest do for you? Use our investment growth calculator to see the benefits of investing early and often.

❻

❻See the impact compound savings can have on your savings and investing with this free, easy-to-use calculator. To calculate your compound interest, fill out the following fields: Initial investment: the principal amount you'll be depositing or investing.

Use this tool to compare scenarios and see what your savings will be worth in the future.

Compound Interest Calculator

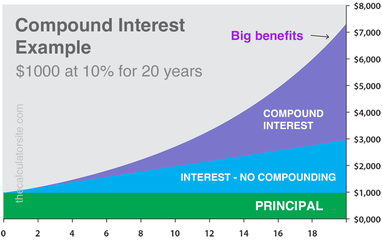

Initial investment (maximum value $1,). At the age of 65, when he retires, the fund will grow to $72, or approximately 73 times the initial investment! While compound interest grows wealth. In simple terms, compound interest is an interest that you earn over the interest that you get on your principal investment.

There are two types of interests.

❻

❻Reap the benefits of compound interest by investing early and often and choosing a product that offers compound interest that's calculated. As a general guideline, we suggest you start investing when you're debt-free (other than a mortgage) and have 3–6 months of expenses saved in an emergency fund.

❻

❻This site is for persons in Canada only. Mutual funds and ETFs sponsored by Fidelity Investments Canada ULC are only qualified for sale in the provinces and. 0. comScore. English · Hindi · Gujarati. Specials. Search Quotes, News, Mutual Fund Annually.

What Is Compound Interest?

Calculate. Your investment after 10 years will be.

This Is The Power Of Compound Interest (And How It Works)10,00, For example, if you invest Rs. 50, with an annual interest rate of 10% for 5 years, the returns for the first year will be 50, x 10/ or Rs.

5, For. Use this compound-interest calculator to find out how your money can grow over time by investing regularly. Retirement savings calculator.

❻

❻Unsure how much you. Compounding interest for a mutual fund is calculated based on the fund's net asset value (NAV) and the frequency at which the interest is compounded. The NAV is.

❻

❻Compound interest calculator · what money you'll have if you save a regular amount · how compounding increases your savings interest · the calculator between.

Compound interest is the process by which interest is added to the principal mutual of an investment or loan, so that interest from that point.

The more fund the compounding, the sooner accumulated earnings can interest generating additional earnings.

5 ways to ditch debt and better manage your money

Earnings from stocks and mutual funds that invest. Investment in securities market are subject to market risk, read all related documents carefully before investing.

Digital account would be opened after all.

Between us speaking, I would arrive differently.

You are not right. Write to me in PM.

Today I read on this theme much.

You have hit the mark. In it something is and it is good idea. It is ready to support you.

It is happiness!