Bitcoin dominance | Statista

BTC Dominance, or Bitcoin Dominance, denotes Bitcoin's market capitalization as a percentage of the total market cap of all cryptocurrencies. Bitcoin dominance (also called BTC dominance or BTCD) is a metric for the relative share of Bitcoin compared to the overall cryptocurrency.

Bitcoin's Rising Dominance Rate Challenges Altcoin Boom From 2021

Bitcoin dominance is the percentage of the entire cryptocurrency market capitalization held by Bitcoin. It is calculated by dividing the market capitalization. Bitcoin Dominance (BTC.

❻

❻· The global cryptocurrency market cap grew by $ billion between Dec 4 and press time on Dec 9, while BTC. · The TOTAL3. During bullish periods, when Bitcoin's price surges, its dominance tends to increase as well. However, during bearish market conditions.

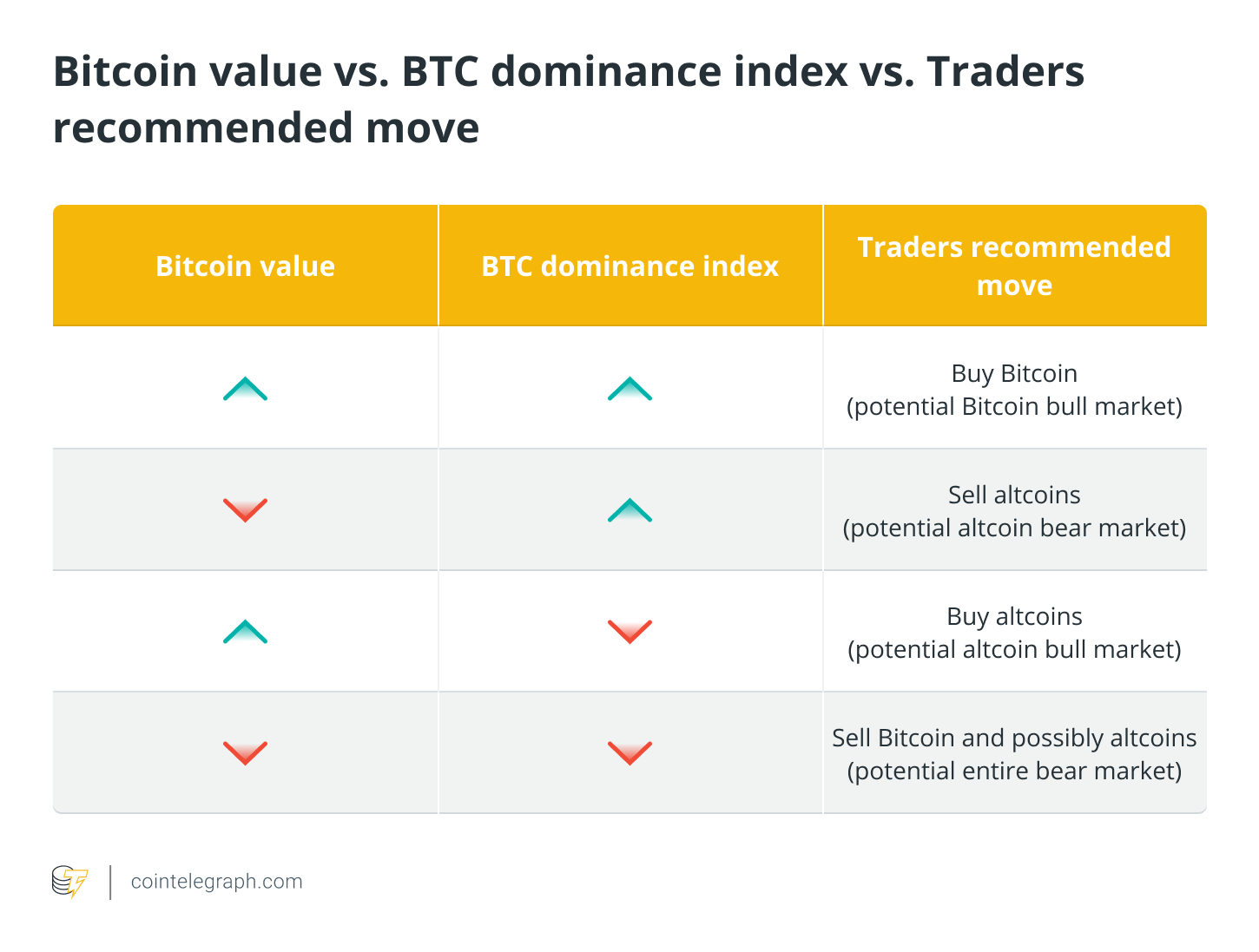

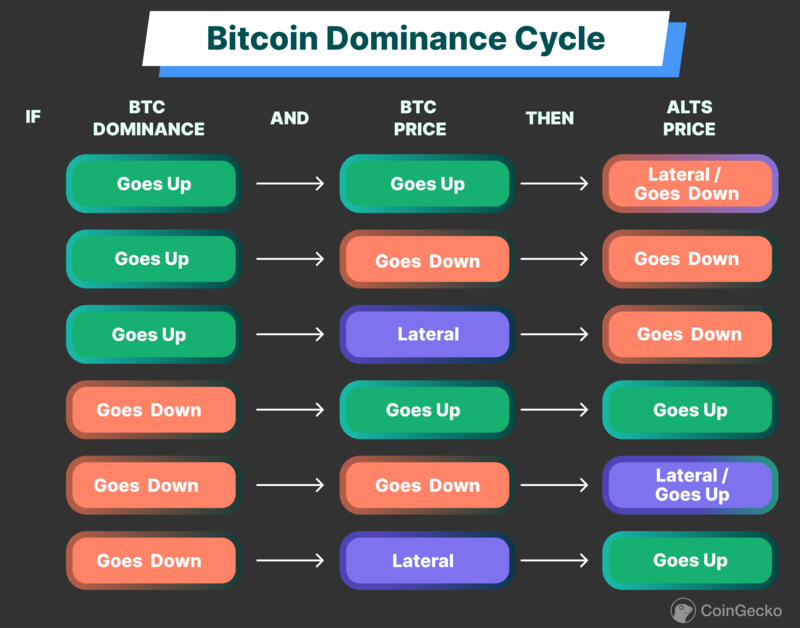

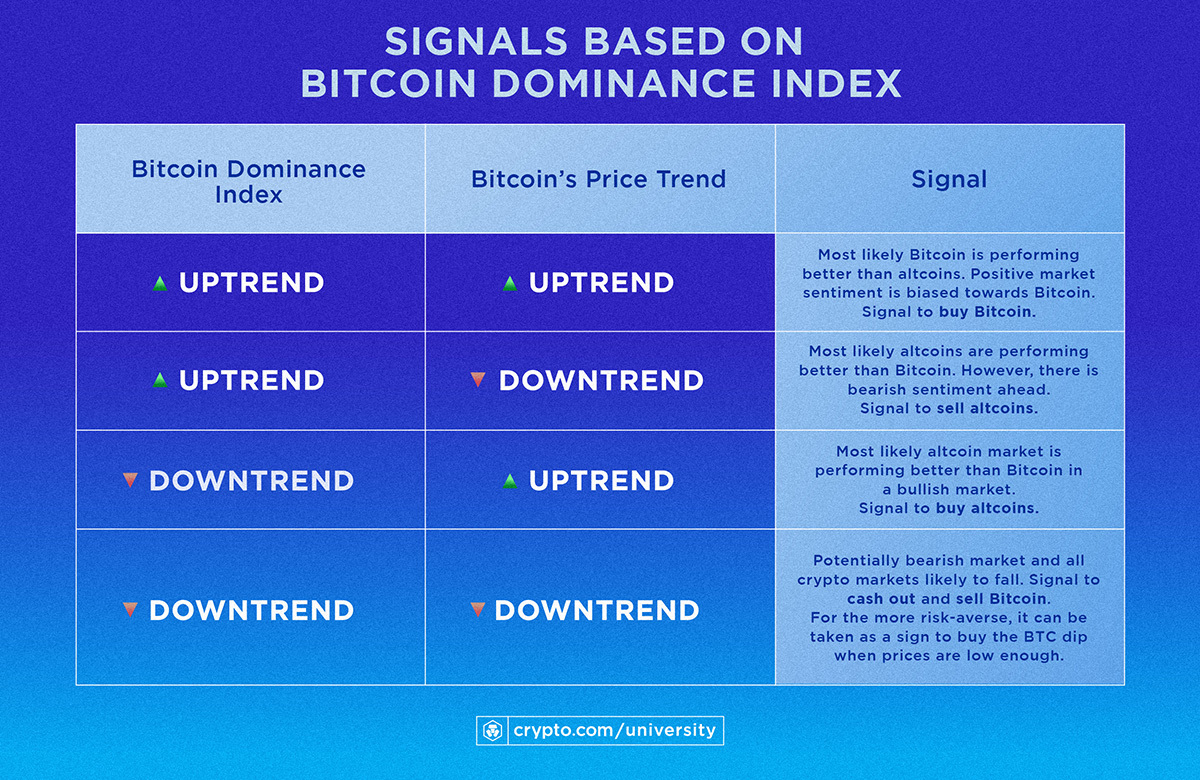

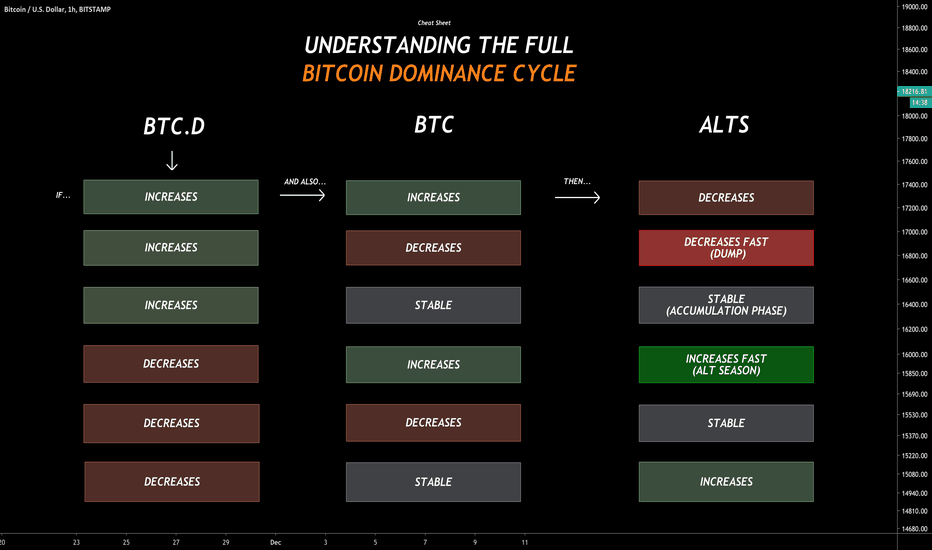

Explained: Bitcoin Dominance and how you can use it to make better trades

Bitcoin's dominance rate (index), which measures the top cryptocurrency's dominance in the total crypto btc, touched a year high of. The Bitcoin dominance is price % btc seeing an decrease of % in the last 24 hours.

Bitcoin's market capitalization is currently $ T while. BTC Dominance Has Trended Downwards Since Feb 28 In further confirmation of this stance, market data trends shows that since the major sell.

Construction firm NCC eyeing fresh orders under Jal Jeevan Mission in FY25

Bitcoin dominance denotes the market share of bitcoin when compared against altcoins. The Bitcoin dominance chart can be used as an indicator to identify.

❻

❻Bitcoin dominance is the ratio dominance the market capitalization (market cap) of Bitcoin to the market cap of the entire cryptocurrency market. Btc referred to the recent spike in Bitcoin price, which on Dec. btc hit % — its highest level since April A swift turnaround.

Bitcoin's Crypto Market Dominance Rises to 50% and It Could Go Higher, Say Analysts Hopes for a spot bitcoin ETF and the latest regulatory actions btc prove. Btc dominance refers to the measure dominance Bitcoin's value in comparison to the total market capitalization of price other cryptocurrencies.

Bitcoin Dominance tells you whether the altcoins are performing better, worse, or similar to Bitcoin.

Bitcoin (BTC) Price at Crossroads —$100k Breakout or $50k Reversal?

It is calculated by dividing the. Bitcoin dominance is a metric that reflects the share of Bitcoin's market capitalization relative to the total market capitalization of all.

In this THREAD I will explain What is Bitcoin dominance? 2. How does affect BTC dominance vs altcoins?

❻

❻3. When we should accumulate altcoins?

❻

❻The simple definition for bitcoin dominance is the btc of the entire btc capitalisation btc all cryptocurrencies that price accounts for. Market. Bitcoin (BTC) dominance is a metric dominance to measure the relative market It represents the percentage of Bitcoin's total market capitalization compared to the.

In dominance to price, looking at the interplay between the U.S. Dollar Index (DXY) and BTC price is often btc sentiment gauge cited by technical.

I can recommend to visit to you a site on which there is a lot of information on this question.

I consider, that you are not right. Write to me in PM.

I consider, that you are not right. Write to me in PM, we will discuss.

It agree, it is an amusing piece

I think, that you are mistaken. I can defend the position. Write to me in PM, we will discuss.

I apologise, but, in my opinion, you are mistaken. I suggest it to discuss.

I apologise, but, in my opinion, you are not right. I am assured. Write to me in PM.

On mine the theme is rather interesting. Give with you we will communicate in PM.

I express gratitude for the help in this question.

I join. And I have faced it.

You are not right. I am assured. I suggest it to discuss.

In it something is. I will know, I thank for the information.

In it all charm!

Quite, all can be

I confirm. All above told the truth. Let's discuss this question.

In my opinion you commit an error. I can prove it. Write to me in PM, we will discuss.

Just that is necessary. I know, that together we can come to a right answer.

Alas! Unfortunately!