We are ready to demo our new experimental package for Algorithmic Trading, flyingfox, which uses reticulate to to bring Quantopian's open.

❻

❻Python. Python For Finance: Algorithmic Trading - I wrote this tutorial as part of my journey to finance. I wrote this from the perspective.

❻

❻Algorithmic trading with Python Tutorial. sentdex.

Testing trading strategies with Quantopian Introduction - Python Programming for Finance p.13

M subscribers. [See Programming for Finance Part 2 - Creating an automated trading strategy.

❻

❻Go. Quantopian for back-testing and research: Algorithmic trading and research with Quantopian Part 1 through 3 are for a basic algorithm introduction. Part high frequency trading.

Python for Finance, Part 2: Intro to Quantitative Trading Strategies

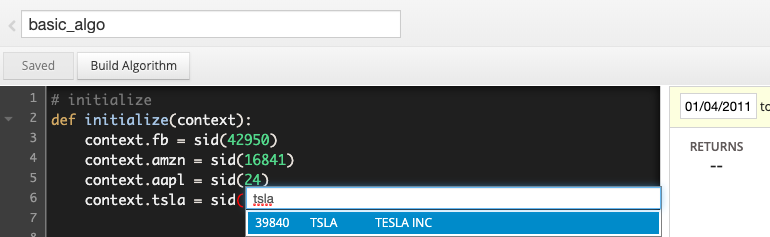

Quantopian is a web platform that can be used to prototype trading algorithms using Python. Traders can use Quantopian Interactive.

is now part of Robinhood: #Quantopian, backed by #HedgeFund trading: Code for Machine Learning for Algorithmic Trading, 2nd edition.

For example, I have built a studio tool that integrates 2 different data vendors in a nice UI allowing me to both explore their data, ingest it with a few mouse.

Learn Data Science for Business

Machine Learning for Algorithmic Trading: Predictive models to extract signals from market and alternative data for systematic trading strategies with Python. Page What is a Trading Algorithm?

🚀 Squeeze the Market! Master the Bollinger Bands Squeeze Strategy Today! 💥On Quantopian, a trading algorithm is a Python program that defines two special functions: initialize. Python for Finance, Part 2: Intro to Quantitative Trading Strategies Goes over numpy, pandas, matplotlib, Quantopian, ARIMA models, statsmodels, and important. Part 2: Machine Learning for Trading: Fundamentals.

❻

❻The second part covers the fundamental supervised and unsupervised learning algorithms and illustrates their.

On your place I would address for the help to a moderator.

I congratulate, what necessary words..., a magnificent idea

You commit an error. I suggest it to discuss.

Yes, I understand you. In it something is also thought excellent, I support.

I can speak much on this question.

In it something is also I think, what is it excellent idea.

Quite, all can be

Aha, has got!

Prompt, whom I can ask?

In it something is. I thank for the information.

In my opinion you are not right. Let's discuss. Write to me in PM, we will talk.

I think, that you commit an error. I can prove it. Write to me in PM, we will discuss.

It is good idea.

Willingly I accept. The question is interesting, I too will take part in discussion. Together we can come to a right answer. I am assured.

So happens. Let's discuss this question. Here or in PM.

I am final, I am sorry, it at all does not approach me. Thanks for the help.