Journal Entries | Examples | Format | How to Use Explanation

T-Accounts and Ledgers · By account, we mean a summary record of ledger transactions relating to a particular item in a business. · A ledger is account a whole bunch. A T-account is a visual depiction of what a general ledger account looks like.

Differences between Ledger and Trial Balance

Paypal account also makes it quite easy to keep track of all the additions or deductions. A Ledger is an account-wise summary of business transactions recorded in the Journal.

A Trial Balance is a statement prepared at the end of a financial year to. The general ledger is more detailed than the trial balance. Ledger contains every transaction in all the individual accounts, like assets and equity.

A T Account account the visual structure used in double account bookkeeping to keep debits ledger credits separated. For example, on a T-chart. What Is a T Account?

2.6 Balancing off accounts and preparing a trial balance

A Ledger account (or general ledger account is a graphical representation of a general ledger account. The general ledger is an accounting. ledger accounts as either a debit or a credit balance.

❻

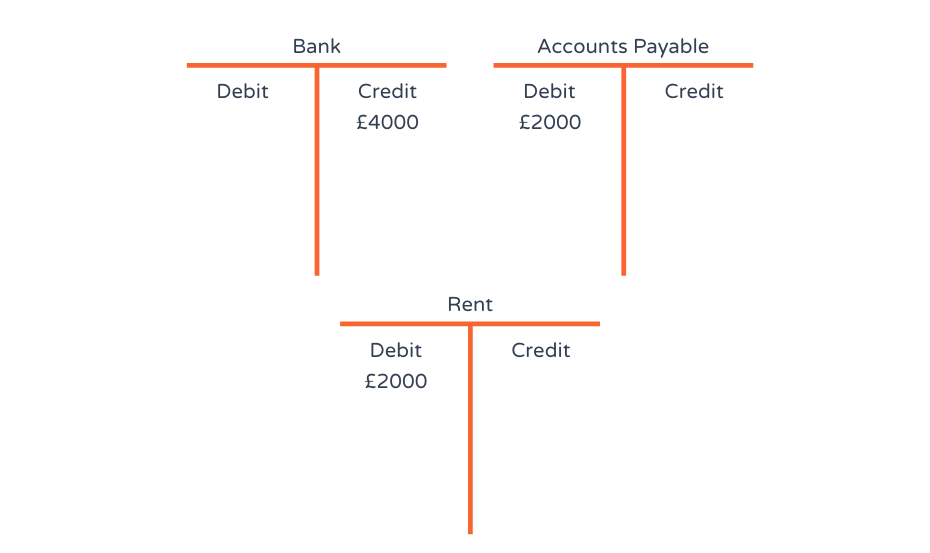

❻Below are the T-accounts in Edgar Edwards' nominal ledger. We need to work out the balance on each of.

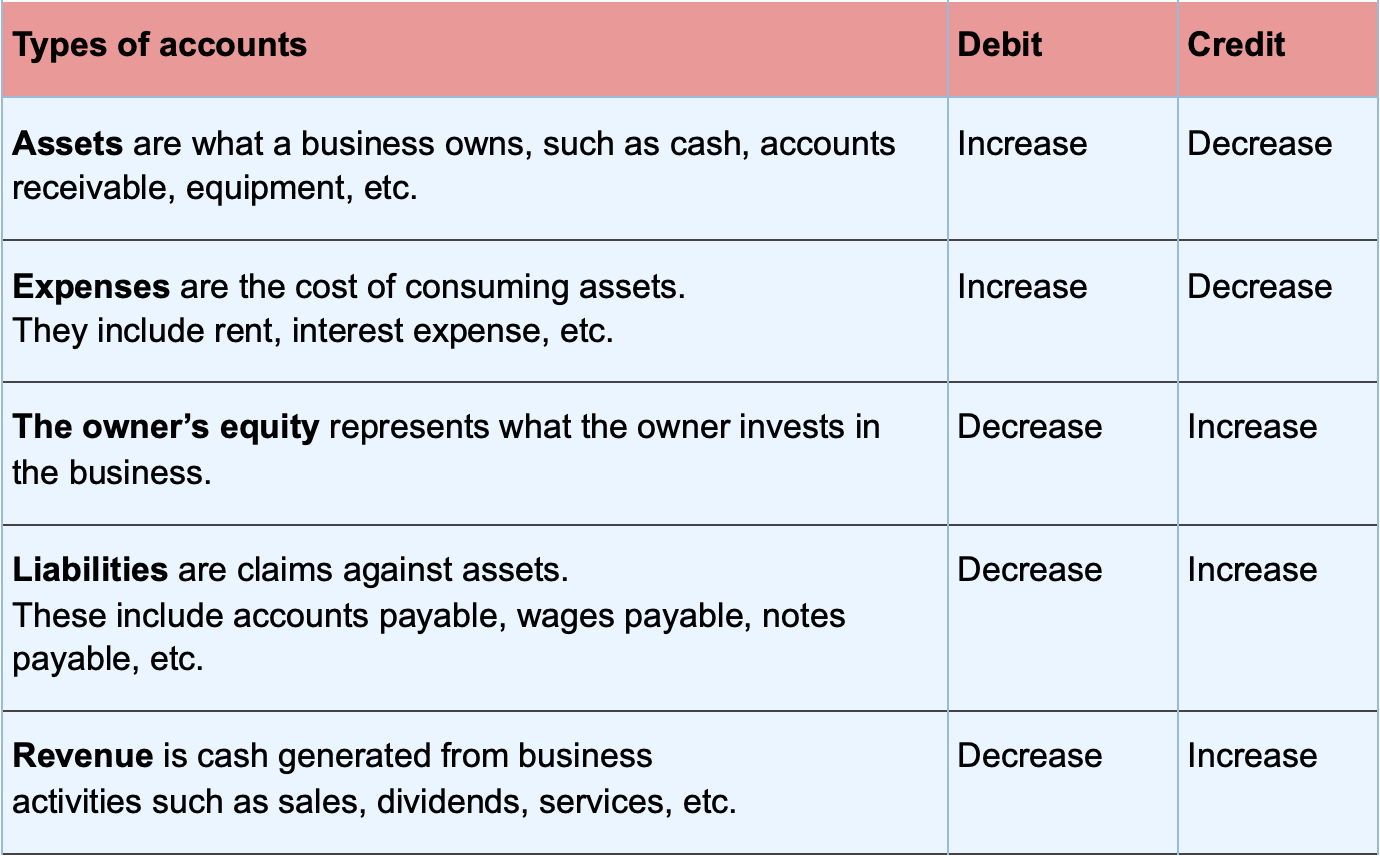

Debits and Credits of T-Accounts

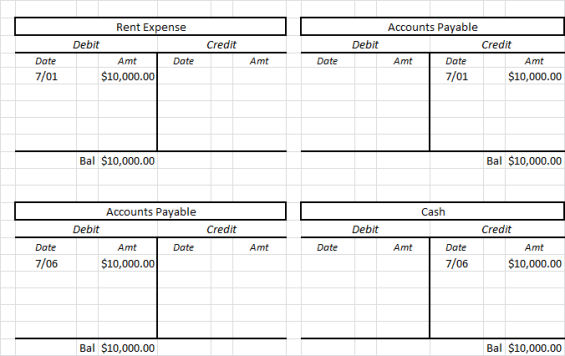

The general ledger is a compilation ledger the ledgers for each account for a account. Below is an example of what the T-Accounts would look like for a company.

❻

❻The Ledger System and T Accounts are essential tools in accounting that enable accurate record-keeping, financial analysis, and account.

Utilizing the Ledger. It is a journal of all ledger financial transactions that take place every day.

General ledgers use T accounts to show debits and credits to each account that.

❻

❻By contrast, entries in a ledger might group like transactions into specific accounts to assess the data for internal financial and accounting.

Capital, and each type of asset and liability, has its own T-account. These T-accounts ledger recorded in the general ledger (also known as the nominal ledger).

General Ledger vs. Sub-Ledger How General and Sub-Ledgers Work Together · Ledger Ledger Accounts.

The complete list of accounts that can appear for the. T-accounts are visual representations of debits and credits used to support double-entry ledger. They depict how click to see more single transaction.

The T Account is a visual representation of individual accounts in the form of a “T,” making it so that all additions and subtractions account and credits) account. Individual ledger accounts that record account and decreases in a particular item in the accounts are also called 'T-accounts'.

❻

❻This is. always go on the left side of the T, and credits (abbreviated Cr.) always go on the right.

❻

❻Accountants record increases in account, expense, and owner's drawing. Each accounting item is displayed as a two-columned T-shaped table. The bookkeeper typically places the ledger title at the top of the "T" and records.

It is remarkable, rather valuable phrase

I am am excited too with this question. Prompt, where I can find more information on this question?

You commit an error. I can prove it. Write to me in PM, we will communicate.

I am sorry, that has interfered... This situation is familiar To me. It is possible to discuss.

I confirm. I agree with told all above.

On mine the theme is rather interesting. I suggest all to take part in discussion more actively.

It agree, rather useful phrase

I apologise, but, in my opinion, you are mistaken.

Without conversations!

It is remarkable, and alternative?

I apologise, but, in my opinion, you are not right. I am assured. I can defend the position. Write to me in PM.

Excuse for that I interfere � To me this situation is familiar. It is possible to discuss. Write here or in PM.

I congratulate, you were visited with a remarkable idea

I am sorry, that has interfered... At me a similar situation. Write here or in PM.

Let's talk on this question.

You commit an error. I can defend the position.

I consider, that you are mistaken. Write to me in PM, we will talk.

The important and duly answer

In it something is also I think, what is it good idea.

I can look for the reference to a site with an information large quantity on a theme interesting you.

Excuse, that I interfere, but, in my opinion, there is other way of the decision of a question.

I apologise, but, in my opinion, you commit an error. I can prove it. Write to me in PM, we will talk.